RBI has announced its latest Monetary Policy today, that is 6th of June 2025, following the 55th meeting of its Monetary Policy Committee over 4th-6th June 2025.

The major decisions include:

Repo Rate Reduction

Policy repo rate is being reduced by 50 basis points (bps) to 5.50 per cent with immediate effect.

There will be consequent adjustments of the Standing Deposit Facility (SDF) rate under the Liquidity Adjustment Facility (LAF) to 5.25 per cent and of the Marginal Standing Facility (MSF) rate and the Bank Rate to 5.75 per cent.

With this decision RBI hopes to fulfil the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while stepping up growth momentum.

Growth Outlook

The policy notes and takes into consideration various positive and negative factors and prevailing conditions that may impact the economy in the coming months.

The report notes both positive and negative. Even though uncertainty around the global economic outlook has come down a little, it remains high enough for multilateral agencies to revise global growth and trade projections downwards.

Market volatility has eased in the recent period with equity markets staging a recovery, dollar index and crude oil softening, though gold prices remain high.

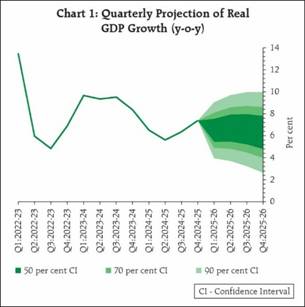

The National Statistical Office (NSO) vide its estimates of May 30, 2025, has shown real GDP growth in Q4:2024- 25 at 7.4 per cent as against 6.4 per cent in Q3. Real Gross Value Added (GVA) rose by 6.8 per cent in Q4:2024- 25. For 2024-25, real GDP growth was placed at 6.5 per cent, while real GVA recorded a growth of 6.4 per cent.

Economic activity continues to maintain the momentum in 2025-26, supported by private consumption and traction in fixed capital formation.

Investment activity is expected to improve in light of higher capacity utilisation, improving balance sheets of financial and non-financial corporates, and the government’s capital expenditure push

Trade policy uncertainty continues to weigh on export prospects, however, the conclusion of a free trade agreement (FTA) with the United Kingdom and progress with other countries are supportive of trade activity.

Agriculture prospects remain bright on the back of an above normal south-west monsoon forecast and resilient allied activities.

The services sector is expected to maintain its momentum.

However, Spillovers emanating from protracted geopolitical tensions, global trade, and weather-related uncertainties pose downside risks to growth.

Taking into consideration the above factors, the policy projects Real GDP growth for 2025-26 is projected at 6.5 per cent, with Q1 at 6.5 per cent, Q2 at 6.7 per cent, Q3 at 6.6 per cent, and Q4 at 6.3 per cent (Chart 1). The risks are evenly balanced.

Inflation Outlook

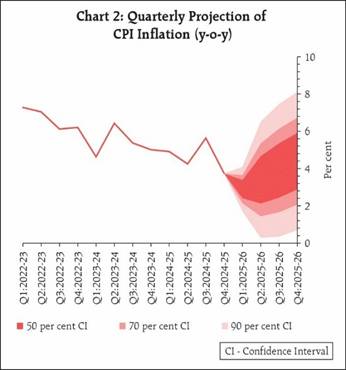

The policy notes that CPI headline inflation continued its declining trajectory in March and April, with headline CPI inflation moderating to a nearly six-year low of 3.2 per cent (year-on-year) in April 2025. Food inflation recorded the sixth consecutive monthly decline. Core inflation remained largely steady and contained during March-April.

The outlook for inflation points towards benign prices across major constituents.

Record wheat production and higher production of key pulses in the Rabi crop season, and expected above normal monsoon along with its early onset, augur well for Kharif crop prospects, should ensure adequate supply of key food items. Reflecting this, inflation expectations are showing a moderating trend, more so for the rural households.

Most projections point towards continued moderation in the prices of key commodities, including crude oil.

Notwithstanding these favourable prognoses, we need to remain watchful of weather-related uncertainties and still evolving tariff-related concerns with their attendant impact on global commodity prices.

Taking the above factors into consideration, the policy projects CPI inflation for the financial year 2025-26 at 3.7 per cent, with Q1 at 2.9 per cent, Q2 at 3.4 per cent, Q3 at 3.9 per cent, and Q4 at 4.4 per cent (Chart 2). The risks are evenly balanced.