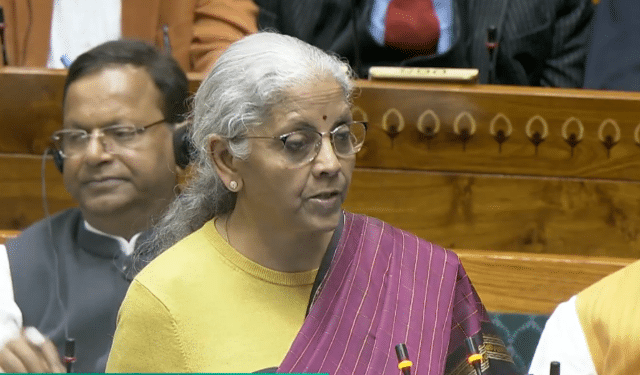

Finance Minister Nirmala Sitharaman presented the Union Budget for 2026-2027 in Parliament today, emphasising India’s resilient economic trajectory amid global uncertainties.

Delivered on the auspicious occasion of Magha Purnima and Guru Ravidas’s birth anniversary, the budget speech highlighted the government’s commitment to stability, reforms, and inclusive growth. Sitharaman underscored the past 12 years of governance under Prime Minister Narendra Modi, noting a consistent 7% growth rate, poverty reduction, and strides in atmanirbharta (self-reliance).

The budget is themed around “Yuva Shakti” (youth power), drawing inspiration from the Viksit Bharat Young Leaders Dialogue 2026, and structured on three “kartavya” (duties): accelerating economic growth, fulfilling people’s aspirations and building capacity, and ensuring Sabka Sath, Sabka Vikas (inclusive development for all). With an eye on global integration, the budget aims to balance ambition with inclusion, positioning India as a hub for manufacturing, services, and innovation.

Accelerating Economic Growth: Manufacturing and Infrastructure Push

Under the first kartavya, Sitharaman outlined ambitious interventions to scale manufacturing in strategic sectors, rejuvenate legacy industries, and bolster infrastructure.

Key manufacturing initiatives include:

- **Biopharma SHAKTI**: A ₹10,000 crore strategy over five years to position India as a global biopharma hub, focusing on biologics and biosimilars. This includes establishing three new National Institutes of Pharmaceutical Education and Research (NIPER) and upgrading seven existing ones, alongside creating 1,000 accredited clinical trial sites.

- **India Semiconductor Mission 2.0**: Building on ISM 1.0, this will emphasize equipment production, IP design, and supply chain fortification.

- **Electronics Components Manufacturing Scheme**: Outlay increased to ₹40,000 crore to capitalize on existing momentum.

- **Rare Earth Corridors**: Support for mineral-rich states like Odisha, Kerala, Andhra Pradesh, and Tamil Nadu to promote mining and processing.

- **Chemical Parks**: Three dedicated parks via challenge mode for plug-and-play clusters.

- **Capital Goods Enhancement**: Hi-Tech Tool Rooms, a Scheme for Construction and Infrastructure Equipment (CIE), and a ₹10,000 crore Container Manufacturing Scheme.

- **Textiles Sector**: An Integrated Programme with five sub-parts for natural fibers, modernization, handlooms, sustainability, and skilling. Mega Textile Parks and the Mahatma Gandhi Gram Swaraj initiative to boost khadi and handicrafts.

- **Sports Goods**: A dedicated initiative for manufacturing and innovation.

Legacy industrial clusters will see rejuvenation for 200 sites through infrastructure upgrades.

For MSMEs, dubbed “Champion SMEs,” a three-pronged approach includes:

- **Equity Support**: ₹10,000 crore SME Growth Fund and ₹2,000 crore top-up for the Self-Reliant India Fund.

- **Liquidity Support**: Enhancements to TReDS, including mandatory use by CPSEs, credit guarantees, and integration with GeM.

- **Professional Support**: “Corporate Mitras” via modular courses from ICAI, ICSI, and ICMAI.

Infrastructure receives a massive boost with public capex rising to ₹12.2 lakh crore from ₹11.2 lakh crore. New measures include dedicated REITs for CPSE real estate, new Dedicated Freight Corridors (Dankuni-Surat), 20 National Waterways, Coastal Cargo Promotion Scheme, Seaplane VGF, and Carbon Capture Utilization and Storage (CCUS) with ₹20,000 crore outlay.

City Economic Regions (CERs) in Tier II/III cities will get ₹5,000 crore each over five years. Seven High-Speed Rail corridors were announced as “growth connectors,” linking cities like Mumbai-Pune and Delhi-Varanasi.

In the financial sector, a High-Level Committee on Banking for Viksit Bharat, restructuring of PFC and REC, and reviews of FEMA rules aim to enhance stability and investment.

Fulfilling Aspirations: Skilling, Health, Education, and Services

The second kartavya focuses on capacity building, with emphasis on the services sector to achieve 10% global share by 2047. A High-Powered “Education to Employment and Enterprise” Standing Committee will prioritize growth areas, including AI’s impact on jobs.

Sector-specific proposals:

- **Health**: Upgrading Allied Health Professionals institutions to add 100,000 AHPs; training 1.5 lakh caregivers; five Regional Medical Hubs for tourism; three new All India Institutes of Ayurveda and upgrades to WHO’s Traditional Medicine Centre.

- **Animal Husbandry**: Loan-linked subsidies for veterinary facilities, adding 20,000 professionals.

- **Orange Economy**: AVGC Content Creator Labs in 15,000 schools and 500 colleges; new National Institute of Design in the east.

- **Education**: Five University Townships near industrial corridors; girls’ hostels in every district for STEM; upgrades to four telescope facilities.

- **Tourism**: National Institute of Hospitality; upskilling 10,000 guides; National Destination Digital Knowledge Grid; sustainable trails for trekking, turtles, and birds; development of 15 archaeological sites.

- **Sports**: Khelo India Mission for integrated talent pathways and infrastructure.

Inclusive Development: Sabka Sath, Sabka Vikas

The third kartavya targets farmers, Divyangjan, mental health, and regional development.

- **Agriculture**: Initiatives for fisheries (500 reservoirs), animal husbandry entrepreneurship, high-value crops (coconut, cashew, sandalwood), Bharat-VISTAAR AI tool, and SHE-Marts for women-led enterprises.

- **Divyangjan**: Kaushal Yojana for skilling; Sahara Yojana for assistive devices via ALIMCO and PM Divyasha Kendras.

- **Mental Health**: NIMHANS-2 in north India; upgrades to institutes in Ranchi and Tezpur; 50% increase in district hospital trauma centers.

- **Regional Focus**: Purvodaya with East Coast Industrial Corridor, tourism destinations, and 4,000 e-buses; Buddhist Circuits in Northeast.

The 16th Finance Commission grants total ₹1.4 lakh crore to states.

Fiscal Prudence and Estimates

Sitharaman reiterated fiscal consolidation, with debt-to-GDP at 55.6% in 2026-27 (down from 56.1%). Fiscal deficit is 4.4% in RE 2025-26 and 4.3% in BE 2026-27.

| Category | RE 2025-26 (₹ lakh crore) | BE 2026-27 (₹ lakh crore) |

|———-|—————————|—————————|

| Non-Debt Receipts | 34 | 36.5 |

| Net Tax Receipts | 26.7 | 28.7 |

| Total Expenditure | 49.6 | 53.5 |

| Capital Expenditure | 11 | – |

| Fiscal Deficit | 4.4% of GDP | 4.3% of GDP |

| Net Market Borrowings | – | 11.7 |

| Gross Market Borrowings | – | 17.2 |

Tax Reforms: Simplification and Relief

In Part B, direct taxes see major simplifications with the new Income Tax Act 2025 effective April 2026. Key changes:

- Exemptions for motor accident claims interest; reduced TCS on tours (2%), education/medical (2%).

- TDS on manpower at 1-2%; automated lower/nil TDS certificates.

- Extended revision deadlines; staggered filing; PAN-based TDS for NRIs.

- One-time foreign asset disclosure scheme with immunities.

- Rationalized penalties/prosecutions: Integrated orders, reduced pre-payments, updated returns post-reassessment.

- Cooperatives: Extended deductions for feed/seed; inter-society dividends.

- IT Sector: Clubbed safe harbour at 15.5%; threshold to ₹2,000 crore; fast-track APAs.

- Global Business: Tax holiday for cloud services via India; safe harbours for data centers, warehousing, toll manufacturing; exemptions for global talent and MAT for presumptive tax.

Other: Buyback taxed as capital gains with additional promoter tax; raised STT on derivatives; MAT as final tax at 14%.

Indirect taxes focus on exports and green energy:

- Extended exemptions for marine/leather/textiles; duty-free inputs for lithium cells, solar glass, nuclear power, critical minerals.

- Exclusions for biogas CNG; exemptions for aviation components.

This budget, with its youth-driven reforms and fiscal discipline, sets the stage for India’s ascent as a global economic powerhouse, balancing immediate needs with long-term vision.