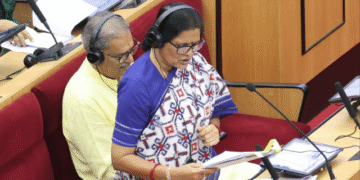

Finance Minister Nirmala Sitharaman presented the Union Budget 2026–27 in Parliament on Saturday, outlining key policy measures that are set to directly impact household expenses and consumer prices across India.

As part of the Budget, the government announced reductions in customs duties and import tariffs on select goods, aimed at supporting domestic manufacturing, healthcare access, green energy, and education. At the same time, duties and levies have been increased on certain items and financial activities to boost revenue and discourage harmful consumption.

Below is a detailed breakdown of items expected to become cheaper and costlier following the Budget announcements.

Items Expected to Get Cheaper After Budget 2026

The following categories may see price reductions due to lower customs duties or tariff rationalisation:

-

Personal-use imported goods

-

17 essential cancer drugs

-

Drugs, medicines, and Food for Special Medical Purposes (FSMP) for seven rare diseases

-

Leather goods, including footwear

-

Textile garments

-

Seafood products

-

Overseas tour packages

-

Lithium-ion cells used in batteries

-

Solar glass

-

Critical minerals

-

Biogas-blended compressed natural gas (CNG)

-

Aircraft manufacturing components

-

Microwave ovens

-

Foreign education expenses

These measures are expected to provide relief to consumers while strengthening sectors such as healthcare, renewable energy, aviation, and clean mobility.

Items Likely to Become Costlier

The Budget also proposes higher duties and taxes on certain items and activities, which could lead to increased costs:

-

Alcoholic beverages

-

Cigarettes and tobacco products

-

Components used in nuclear power projects

-

Minerals including iron ore and coal

-

Penalties related to misreporting of income tax

-

Stock options and futures trading (due to a hike in Securities Transaction Tax)

Will Imported Wine Become Cheaper?

Despite alcohol being listed among items expected to become costlier, there may be partial relief for consumers of imported European wines and spirits.

Under the recently finalised India–European Union Free Trade Agreement, tariffs on 96.6% of EU exports to India will be reduced or eliminated. As a result, products such as wine, beer, select spirits, fruit juices, kiwis, pears, non-alcoholic beer, and processed foods imported from Europe may become more affordable in the coming months.

Key Highlights from Budget 2026–27

In her 81-minute Budget speech, the Finance Minister also addressed:

-

Timelines for income tax return filing

-

Increase in Securities Transaction Tax (STT) on Futures and Options

-

Expansion of India’s semiconductor mission

-

Development of rare earth mineral corridors

The Budget received praise from Prime Minister Narendra Modi and leaders of the ruling alliance, while opposition parties described it as lacking transformative reforms for low-income groups.

Conclusion

The Union Budget 2026 presents a mixed impact for consumers—offering relief in healthcare, clean energy, and education, while tightening levies on alcohol, tobacco, and speculative trading. The actual price impact will unfold as market forces and state-level taxes come into effect.