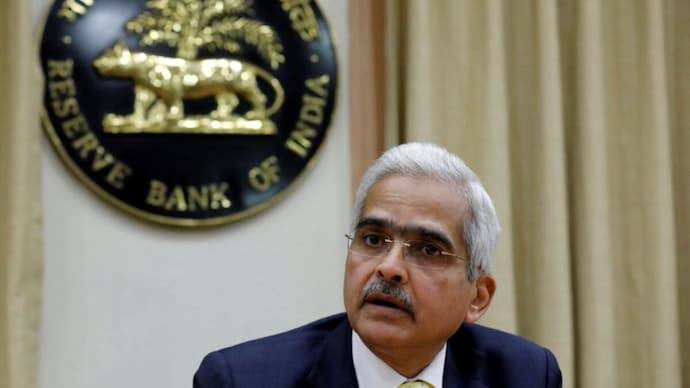

Mumbai: Reserve Bank of India (RBI), on Friday, left the key policy rate unchanged at 6.5 per cent in its monetary policy review for the seventh consecutive time, with the aim of keeping inflation in check and ensuring that the economy moves on a stable growth path.

The MPC’s task is to keep the country’s retail inflation within four per cent with a margin of two per cent on either side. This committee meets at least four times a year to discuss the direction which the central bank wants to take in the financial year as it aims to strike a balance between sustaining growth and maintaining inflation target. After this assessment, the MPC decides whether to maintain, raise, or lower the repo rate.

Repo rate is the rate at which the central bank lends short-term funds to banks. It currently stands at 6.5 per cent and has been unchanged since April 2023. The State Bank of India, in its research report, stated that rate cuts are not likely in the MPC as “strong evidence of emerging economy central bank rate actions are predicated by advanced economy central bank rate actions. India is an exception and the first RBI cut could be in Q3FY25.”