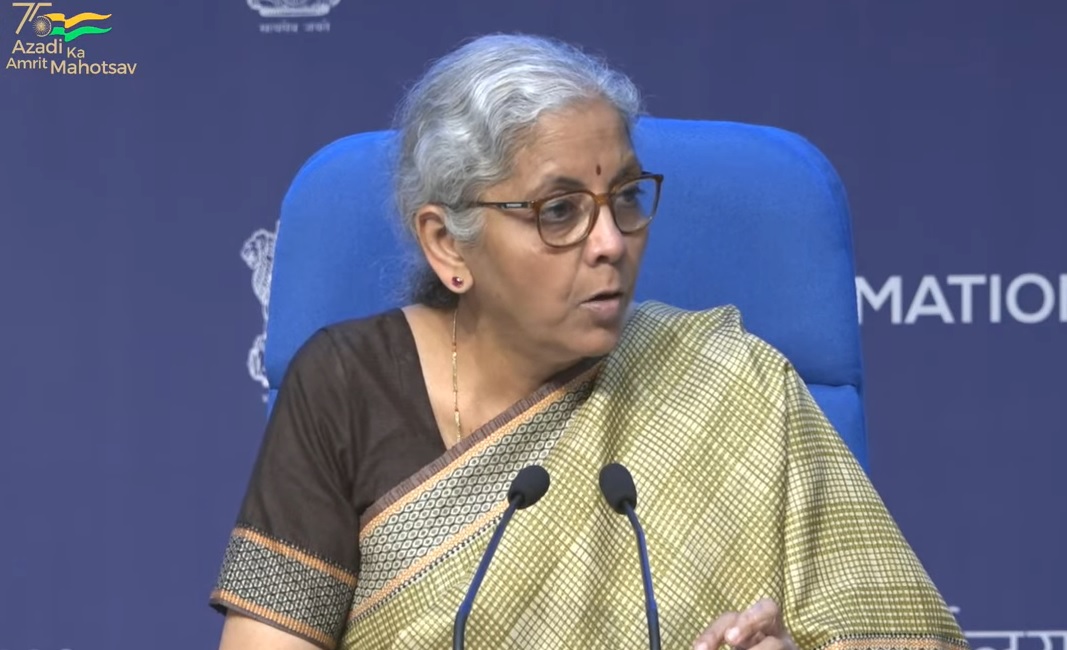

New Delhi: Finance Minister Nirmala Sitharaman on Saturday said Goods and Services Tax (GST) has helped bring down the taxes for consumers by removing the cascading effect of ‘tax-on-tax’ and added to the revenue buoyancy of states.

She said the GST system has seen massive scaling up since its implementation on July 1, 2017, and the benefit accrued to consumers and governments because of GST implementation is an “exemplar”.

“GST has brought in greater tax buoyancy as a result of which, more than your GSDP growth, your tax collection is growing. Therefore, both Centre and states benefit…We have to dispel this myth that states are losing out after having joined hands for GST…Today, no state suffers after GST, and that is despite Covid,” Sitharaman said.

Giving a comparison of tax rates pre and post-GST, Sitharaman said, “GST has done justice to the consumers by bringing the rates down compared to the previous regime”.

Before GST was introduced, India’s indirect tax system was fragmented, where every state was effectively a distinct market for the industry as well as the consumer.

The multiplicity of taxes in the pre-GST regime resulted in a “tax-on-tax” effect, causing the same product to be taxed multiple times and hence becoming costlier for the consumers, she said at the GST Day 2023.

“The introduction of GST has brought the actual tax on consumers down and in some cases, remarkably down. Despite this reality, you still have a lot of people confusing the minds of people saying ‘GST has burdened the society’. Actually not,” Sitharaman noted.

GST has also made sure that only that much tax, which is genuinely due to the government, is being collected systematically without any personal level of discretion, she said, adding GST has made life easy for small businesses and easy for goods to move freely in the country.

“Whether it is common consumer, whether it is the state government, a matter of tax buoyancy, whether it is making it digital and simpler, GST stands out as an exemplar,” Sitharaman said.

Giving data, Sitharaman said the revenue buoyancy of states improved from 0.72 in the pre-GST era, to 1.22 post-GST rollout.

Before GST, the state’s tax revenue growth was 8.3 per cent while GDP growth was 11.5 per cent, which means a low tax buoyancy of 0.72. This means that states’ tax revenues were growing slower than the GDP.

After GST, tax growth was 12.3 per cent, while GDP growth was 9.8 per cent, resulting in a higher buoyancy of 1.22.

Post-GST revenue buoyancy of states is much higher than pre-GST buoyancy, Sitharaman said.

“Now the quick recovery, the new normal (in the collection) all prove that states have not lost out, and on the contrary, their tax buoyancy has gone up post GST”.

The minister said GST means double tax being avoided and relief to the common man in terms of tax rates coming down.