New Delhi: Launched on September 12, 2019, the Pradhan Mantri Kisan Maandhan Yojna (PM-KMY) has been providing social security to all land-holding Small and Marginal Farmers (SMFs) across the country.

This old-age pension scheme is a voluntary and contributory pension scheme. Under the initiative, eligible small and marginal farmers are given a fixed monthly pension of Rs. 3,000 after attaining the age of sixty. To qualify, farmers contribute monthly to the pension fund during their working years, with matching contributions from the central government.

This landmark scheme to provide a safety net to farmers in their old age has completed five years of its implementation.

Successful Implementation of PM-KMY

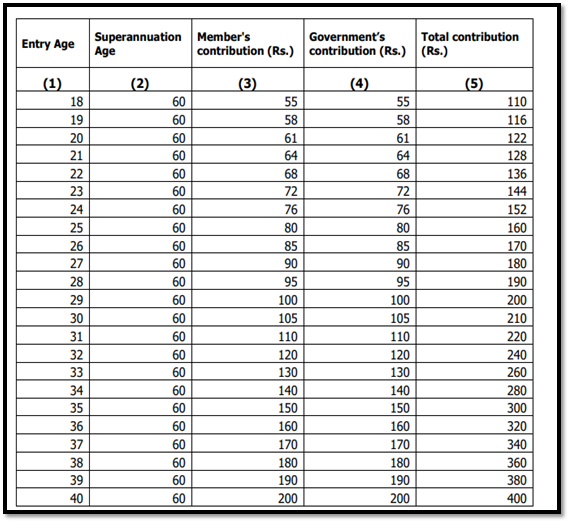

Under Pradhan Mantri Kisan Maandhan Yojna (PM-KMY), small and marginal farmers can enrol by paying a monthly subscription to the Pension Fund. Farmers aged between 18 and 40 years need to contribute between Rs. 55 to Rs. 200 per month until they turn 60.

Once they reach the age of 60, enrolled farmers receive a monthly pension of Rs. 3,000, provided they meet the scheme’s exclusion criteria. The Life Insurance Corporation (LIC) manages the pension fund, and beneficiary registration is facilitated through Common Service Centres (CSCs) and State Governments.

All farmers with cultivable land holdings of up to 2 hectares and listed in state/UT land records as of 1st August 2019 are eligible for benefits under the scheme. As of August 6, 2024, a total of 23.38 lakh farmers have joined the scheme.

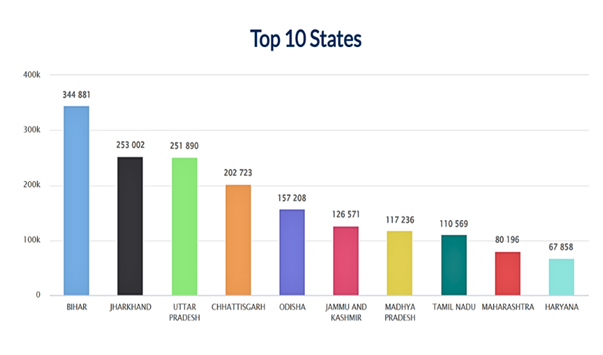

Under the scheme, Bihar leads with over 3.4 lakh registrations while Jharkhand ranks second with over 2.5 lakh registrations.

Further, Uttar Pradesh, Chhattisgarh, and Odisha have over 2.5 lakh, 2 lakh, and 1.5 lakh farmer registrations, respectively. The huge registration reflects strong uptake in these states, highlighting the scheme’s reach and impact in providing social security to farmers. The widespread participation also underscores the growing awareness and adoption of the PM-KMY initiative among small and marginal farmers.

Key Benefits Under PM-KMY

- Minimum Assured Pension: Each subscriber to the scheme is guaranteed a minimum pension of Rs. 3000 per month upon reaching the age of 60 years

- Family Pension: If a subscriber passes away while receiving their pension, their spouse will be entitled to a family pension equal to 50% of the amount the subscriber was receiving i.e. Rs.1500 per month as Family Pension. This is only applicable if the spouse is not already a beneficiary of the scheme. The family pension benefit is exclusively for the spouse.

- PM-KISAN Benefit: SMFs can choose to use their PM-KISAN benefits to make voluntary contributions to the scheme. For this, eligible SMFs must sign and submit an enrolment-cum-auto-debit-mandate form. This will authorize automatic debit of their contributions from the bank account where their PM-KISAN benefits are credited.

- Equal Contribution by Government: The Central Government, through the Department of Agriculture Cooperation and Farmers Welfare, also contributes an equal amount as contributed by the eligible subscriber, to the pension Fund

- Monthly Contributions: Monthly contributions are in the range from Rs. 55 to Rs. 200, based on the farmer’s age at the time of entry into the Scheme, according to the contribution chart.

Entry Age-Specific Monthly Contribution Chart

Enrolment Process

To enrol in the scheme, eligible farmers need to visit the nearest Common Service Center (CSC) or contact the Nodal Officer (PM-Kisan) appointed by the State or UT Governments. Registration can also be completed through the scheme’s official web portal at www.pmkmy.gov.in.

The beneficiary will provide the following information at the time of registration:

● Farmer’s / Spouse’s name and date of birth

● Bank account number

● IFSC/ MICR Code

● Mobile Number

● Aadhaar Number

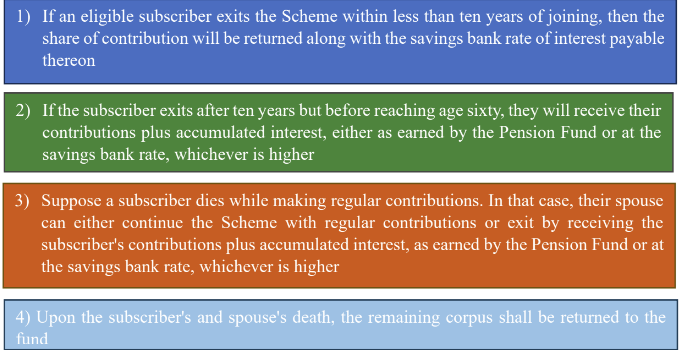

Leaving the Pension Scheme

Conclusion

Over five years of implementation, the PM-KMY has significantly empowered Small and Marginal Farmers (SMFs) across India. One of the key achievements of PM-KMY is its role in providing financial stability to farmers, many of whom face uncertain futures due to the seasonal nature of agriculture and fluctuating incomes.

By securing a pension for their retirement years, the scheme has addressed a significant gap in social security for the rural population. Its success over the past five years underscores its critical role in enhancing one of the country’s ‘Annadata’ quality of life.