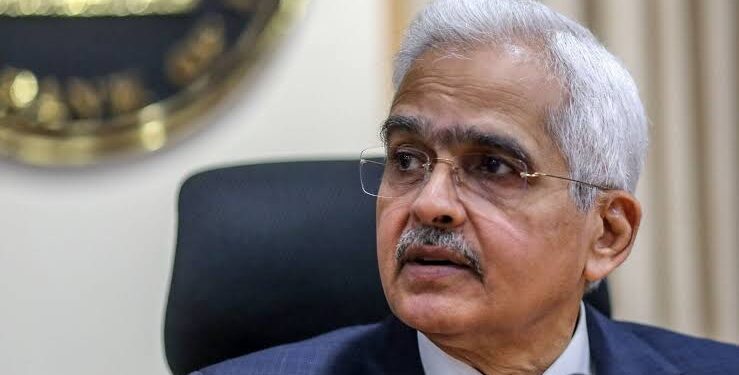

Mumbai: Reserve Bank of India (RBI) Governor Shaktikanta Das has ruled out the possibility of an immediate rate cut, citing ongoing inflationary pressures as a significant concern.

Speaking at the BFSI Insight Summit on Wednesday, Das emphasized that the recent shift to a neutral monetary policy stance should not be interpreted as a signal for imminent rate reductions.

“Changing our stance to neutral does not mean that a rate cut is on the horizon,” Das clarified. “There are still substantial upside risks to inflation, and reducing interest rates at this juncture would be premature and very risky”.

The RBI has maintained the policy repo rate at 6.5% for the tenth consecutive time, despite speculation that the neutral stance might pave the way for future rate cuts. Das highlighted several factors contributing to inflationary pressures, including geopolitical conflicts, geo-economic fragmentation, and rising commodity prices.

Recent data shows that retail inflation rose to 5.5% in September, driven primarily by escalating food prices. Das warned that October’s inflation figures are expected to be similarly high, reinforcing the need for caution in monetary policy adjustments.

While acknowledging the mixed signals from the economy, Das remained optimistic about India’s economic resilience. He pointed to robust car sales in October as a positive indicator, although he noted that urban fast-moving consumer goods sales remain subdued.

The RBI’s commitment to achieving its 4% inflation target on a sustained basis remains steadfast. Das reiterated that any easing measures would only be considered once inflation shows a durable decline.