New Delhi: Fixed Deposits have long been a preferred investment choice for individuals seeking stability, security, and steady returns. Offering a conservative yet reliable avenue for wealth preservation and growth, FDs remain a cornerstone of many investors’ portfolios.

Often there is a lost of confusion while opening your FD with regard to the amount you should be investing, where to open an FD account, how to choose a tenor and the best time to invest.

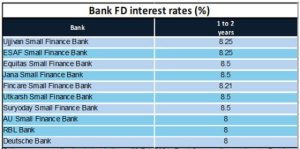

One of the key considerations for FD is that people want to earn higher interest rates. The higher interest rate means that you will get a significant amount on the maturity of the FD.

This is one of the reasons why interest rate matters a lot for FD investors. Another thing to keep in mind is the tenor based on your goal. For example, if you invest Rs 3 lakh for 3 years and earn an interest of 8%, your maturity amount would be Rs 3,80,473. On the other hand, if you earn 7%, the maturing amount will be Rs 3,69,432. That is why interest plays a big role in the FD investment.