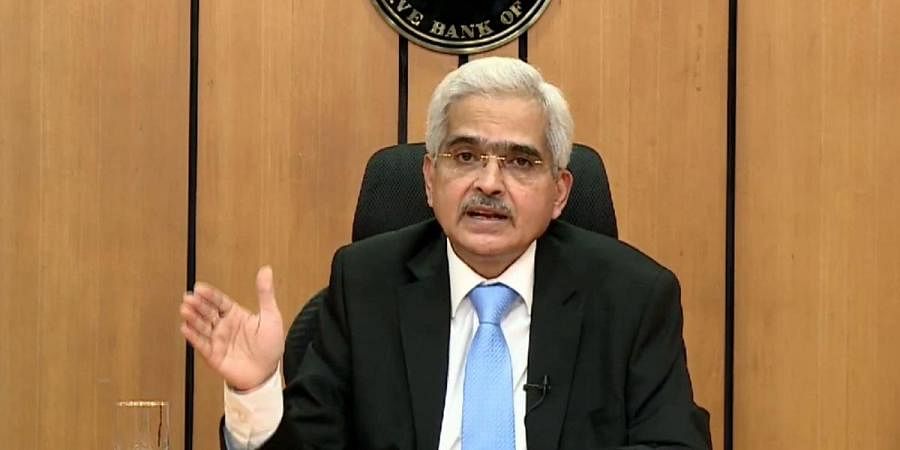

Mumbai: Reserve Bank Governor Shaktikanta Das on Thursday urged banks and NBFCs to continue the process of augmentation of capital and building up appropriate buffers to meet future uncertainties.

Unveiling the bi-monthly policy, Das said RBI has been watchful of the impact of the pandemic on the banking and NBFC sectors when the effects of regulatory reliefs and resolutions fully work their way through.

The Reserve Bank has accorded the highest priority to preserving financial stability by taking quick and decisive steps to ease liquidity constraints, restore market confidence and prevent contagion to other segments of the financial market, he said.

Thus, he said, despite the pandemic-induced bouts of volatility, the Indian financial system has remained resilient and is now in a better position to meet the credit demands as recovery takes hold and investment activity picks up.

The balance sheets of Scheduled Commercial Banks (SCBs) are relatively stronger with higher capital adequacy, reduced NPA, higher provisioning cover and improved profitability than in the previous years, he said.

“Banks and other financial entities would be well advised to further strengthen their corporate governance and risk management strategies to build resilience in an increasingly dynamic and uncertain economic environment. They also need to continue the process of capital augmentation and building up of appropriate buffers,” he said.